How To Calculate Total Asset Turnover Ratio : You'll need a balance sheet from two different periods, such as two consecutive months, to calculate the average assets amount, and make sure you keep the time period consistent with that of your sales figure.

How To Calculate Total Asset Turnover Ratio : You'll need a balance sheet from two different periods, such as two consecutive months, to calculate the average assets amount, and make sure you keep the time period consistent with that of your sales figure.. Quick glance of asset turnover ratio You can use the asset turnover rate formula to find out how efficiently they're able to generate revenue from assets: 500,000 / 2,000,000 = 0.25 x 100 = 25%. As expected, low margin companies would have higher asset turnover ratios since they have to offset lower profits with higher sales. Fixed assets, such as property or equipment, might also be sitting unused and depreciating, instead of generating more goods for sale.

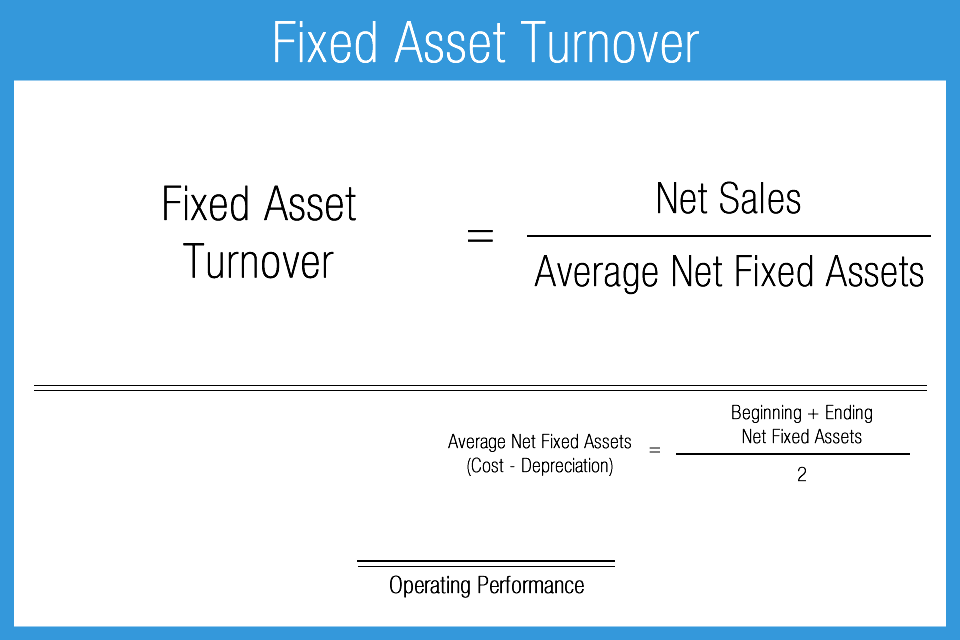

The following equation performs the calculation using numbers on an annual basis. Also, another factor to be considered is for companies operating in the same industry, sometimes a company with older assets will have higher asset turnover ratios since the accumulated depreciationwould be more. It is plausible that for a company asset turnover ratio for any given year might be higher due to various factors such as selling off assets etc. Calculation of weighted average formula 4. As expected, low margin companies would have higher asset turnover ratios since they have to offset lower profits with higher sales.

:max_bytes(150000):strip_icc()/Image-for-Step-6-Ratio-Tutorial_01-56a0a3325f9b58eba4b25431.png)

You'll need a balance sheet from two different periods, such as two consecutive months, to calculate the average assets amount, and make sure you keep the time period consistent with that of your sales figure.

Fixed assets, such as property or equipment, might also be sitting unused and depreciating, instead of generating more goods for sale. Insert these numbers into the total asset turnover equation as follows: For example, suppose company abc had total revenue of $10. Here we will do the same example of the asset turnover ratio formula in excel. it is very easy and simple. The firm could also be stuck with old inventory that doesn't sell, or not selling through inventory fast enough. See full list on thebalancesmb.com In other words, every £1 in assets generates 25 cents in net sales revenue. As expected, low margin companies would have higher asset turnover ratios since they have to offset lower profits with higher sales. Here we discuss its uses along with practical examples. The firm may have a large accounts receivable balance, with few customers paying up front and too many customers paying their credit accounts late. Calculation of weighted average formula 4. See full list on thebalancesmb.com Also while comparing asset turnover ratios, one needs to look at the performance of the companies over the last few years rather than in a single year.

It is plausible that for a company asset turnover ratio for any given year might be higher due to various factors such as selling off assets etc. Hence while comparing asset turnover ratios for companies operating in the same industry this should be one of the factors that need to be taken into consideration. See full list on thebalancesmb.com What does as ideal ratio for total asset turnover? This has been a guide to an asset turnover ratio formula.

The firm could also be stuck with old inventory that doesn't sell, or not selling through inventory fast enough.

Formula for revenue per employee ratio 2. You'll need a balance sheet from two different periods, such as two consecutive months, to calculate the average assets amount, and make sure you keep the time period consistent with that of your sales figure. The firm could also be stuck with old inventory that doesn't sell, or not selling through inventory fast enough. As expected, low margin companies would have higher asset turnover ratios since they have to offset lower profits with higher sales. Insert these numbers into the total asset turnover equation as follows: In other words, every £1 in assets generates 25 cents in net sales revenue. Current assets include cash, inventory, and accounts receivable, while fixed assets include property and equipment. What is asset turnover and how do you calculate it? In other words, every $1 in assets generates 25 cents in net sales revenue. It is pointless to compare the asset turnover ratios between a telecommunications company and an it service company. Asset turnover ratio is also used in dupont analysis to calculate the return on equityof a company. Here we discuss its uses along with practical examples. Quick glance of asset turnover ratio

Fixed assets, such as property or equipment, might also be sitting unused and depreciating, instead of generating more goods for sale. You can use the asset turnover rate formula to find out how efficiently they're able to generate revenue from assets: Asset turnover ratio is a measure that is used to determine how efficiently a company is generating revenues from its assets. This is because sometimes the asset turnover ratio of any company might be inflated or deflated due to some factors such as selling off assets or large asset purchases during any given period. What is a good asset turnover ratio?

As with all ratios, this ratio should also be used while comparing companies across similar industries.

Formula for revenue per employee ratio 2. As with all ratios, this ratio should also be used while comparing companies across similar industries. Hence the comparison of asset turnover ratios between companies is more substantial when it is done between companies that operate in similar industries. Also, another factor to be considered is for companies operating in the same industry, sometimes a company with older assets will have higher asset turnover ratios since the accumulated depreciationwould be more. See full list on educba.com You'll need a balance sheet from two different periods, such as two consecutive months, to calculate the average assets amount, and make sure you keep the time period consistent with that of your sales figure. See full list on educba.com A low ratio result may indicate that the company has experienced internal or external events that triggered a drop in sales. You can use the asset turnover rate formula to find out how efficiently they're able to generate revenue from assets: You need to provide the two inputs i.e net sales and average total assets you can easily calculate the asset turnover ratio using formula in the template provided. Ratios become useful only when compared against the same ratio from another time period for the same company, another similar company in the same business sector, or an average ratio for a group of companies in the same industry. Here we will do the same example of the asset turnover ratio formula in excel. it is very easy and simple. In other words, every $1 in assets generates 25 cents in net sales revenue.

You can use the asset turnover rate formula to find out how efficiently they're able to generate revenue from assets: how to calculate total asset turnover. You can use the asset turnover rate formula to find out how efficiently they're able to generate revenue from assets: